Investor Career

In April 2020, I embarked on my journey as a long-term investor, primarily focusing on US stocks. Over time, I honed my skills in market psychology, enabling me to make informed decisions. As my journey progressed, I delved into the Efficient Portfolios theory, aiming to construct portfolios that optimize returns while minimizing risks. Leveraging my proficiency in Python, I developed a model to facilitate the creation of efficient portfolios.

Furthermore, I dedicated myself to studying corporate finance

and accounting principles, mastering the interpretation of financial statements,

including the balance sheet, income statement, and cash flow statement.

This comprehensive knowledge not only empowered me to navigate the complexities

of the financial markets but also led to significant outperformance

in my investment endeavors.

View Etoro Profile

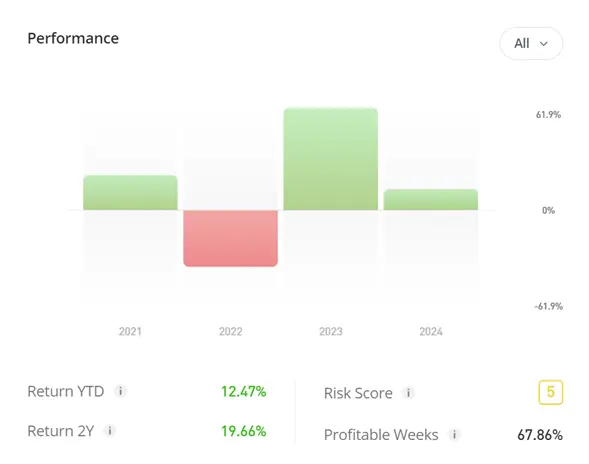

| # | Year | Performance | S&P500 |

|---|---|---|---|

| 1 | 2021 | +20.71% | +28.75% |

| 2 | 2022 | -34.28% | -18.17% |

| 3 | 2023 | +61.87% | +26.19% |

| 4 | 2024 (January) | +12.47% | +2.12% |

| 5 | CAGR | +12.66% | +10.42% |